Comstock | Thinkstock

How much of your salary are you spending on clothing every month? On groceries? On your car? On going out? How much of your salary are you saving every month? If your money just goes—and you’re not quite sure where it goes—maybe it’s time to examine your spending habits.

Here is one classic example for divvying up your salary in a financially responsible way, and getting on track in terms of financial stability. As a nurse, you have a relatively good salary, and it will keep going up as you stay in this profession. There’s no reason why you can’t enjoy life and save for the future at the same time.

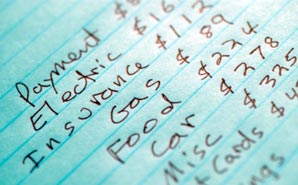

List your fixed costs

First, you need to get a handle on what you’re currently spending, so start by making a list of those items you absolutely must allocate a chunk of your income to every month—and record how much you spend on each of those items. These are your fixed costs, and they include rent or mortgage payments, utilities, childcare expenses, home and vehicle insurance, cable and Internet services, etc. Sometime it’s hard to remember what all of your fixed costs are, so go through your bank statements to make sure you’ve listed all of them.

List your variable costs

These items change from month to month, and include things like groceries, toiletries, clothing, dining out, gasoline for your vehicle(s) and gifts for special occasions. These are even harder to remember than your fixed cost items, so have a look at your bank statements and credit card bills over the past several months (or over the past year if you can) to get an idea of what your variable costs tend to include. Determine an average cost per month for each category of items.

The breakdown

Out of your monthly income, you should be able to cover your fixed costs plus your variable costs, plus you should have some money left over for savings and investments. To make this simple, here’s a snapshot of how a net monthly income of $4,000 could be responsibly divvied up.

$4,000 Net Monthly Income

40% ($1,600) — Fixed Expenses

20% ($800) — Variable Expenses

10% ($400) — Savings for Unexpected Emergencies (This could, for example, include vehicle repairs, replacing an appliance that breaks down or fixing a leaky roof—all very costly. You should build up this savings amount until it can cover at least three to six months of fixed plus variable expenses. You will keep dipping into it and will therefore need to constantly be replenishing it, so putting a fixed amount into it every month is a good idea. If you have a period with very few unexpected emergencies and this savings amount gets very high, you can move some money from here into your other savings streams.)

10% ($400) — Retirement Savings

10% ($400) — Other Savings (for vacations, to buy a cottage or a sailboat, etc.)

10% ($400) — Other Investments (education funds for children, stocks, bonds, etc.)

The bottom line is that you should spend no more than 60 percent of your after-tax income on the expenses of daily living, and you should allocate at least 40 percent of your after-tax income to a variety of savings streams.

Now it’s your turn. Look at your fixed and variable expenses and determine if there are places where you need to make changes. If you have a family, this is an awfully tight budget to work with—and you’ll really have to work at achieving that 40 percent savings per month. Maybe for some months—in September, for example, when you have to pay school fees and buy school clothes—you’ll have to decrease what you allocate into savings. That’s a good time for you to hold back on buying new scrubs for yourself. So, do some advance planning about when to buy certain items. And whenever you skimp on saving one month, try to make up for it in future months.

Maybe you’re currently in a situation where you can save more. You may be single with a good nursing income, and you may not currently have a vehicle. You should be able to allocate less money for expenses and put more into savings.

This formula is just a guide to get you started. You have to tailor it to work for your situation, and the 60/40 balance won’t always be easy to achieve, but if you at least aim for it, you’ll be on the right track.

We’re curious—where are you in your career and what’s your method of divvying up your nursing paycheck?