As you know, nurses work incredibly hard and often make a huge financial investment in their careers. What’s more, nurses face a higher risk of being injured or contracting an illness on the job than workers in other fields. For these reasons, it’s very important that nurses protect their income in case something happens that prevents them from working.

If you’re a nurse, one way you can protect your income is through disability insurance, which is designed to replace your income if you are unable to work due to an injury or illness. Disability insurance differs from workers’ compensation insurance in that workers’ compensation benefits are rewarded to you only when you’re injured at work, while disability insurance covers you even if you are injured away from work and cannot perform your work duties as a result of your injury or illness. Disability insurance, therefore, offers you more protection. One of the most common types of disability insurance for nurses and physicians is “own-occupation” insurance.

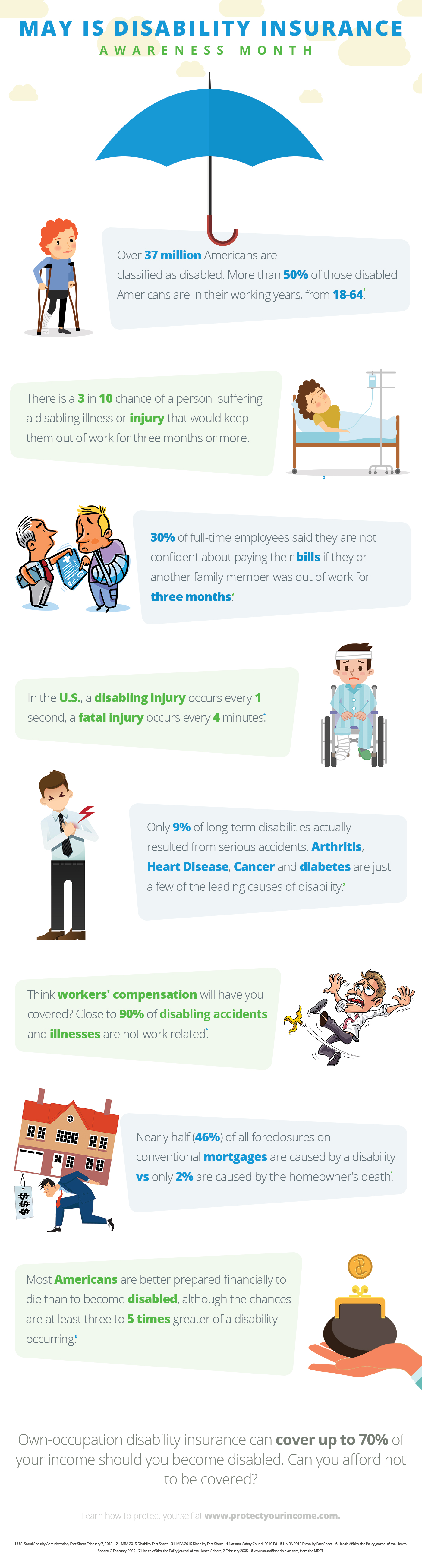

Check out this infographic, and in the article below, we’ll provide some information on what you should know about own-occupation disability insurance and what to look for in a policy.

Protect Yourself Financially

Nursing is one of those careers that requires a great deal of training and investment before you can start working. Nursing school and training programs are very expensive. The average tuition for in-state nursing school is around $900 per semester; books cost around $1,000 total; then there are other costs such as scrubs, criminal background checks, liability insurance, and so on. Many nurses also invest in ongoing training over the years, as well.

The commitment nurses make is not only financial. It is an incredibly hard job and can take a mental and physical toll; nurses often choose this career because they have a strong desire to help people. It’s a mental and emotional investment too.

If you are injured or contract an illness, your investment should be protected. A disability insurance policy can help nurses focus on their own healing, and alleviate financial stress from such things as student loans, mortgage payments, and other payments if they are unable to work.

A Risky Profession

Compared to other professions, nurses are at a high risk of injury and illness, particularly musculoskeletal disorders. In fact, they’re more than three times as likely to suffer a musculoskeletal injury than construction workers. According to the Department of Labor’s Bureau of Labor Statistics (BLS), nursing employees suffer more than 35,000 back and other injuries every year, and many of these employees miss work as a result. It’s vital that you protect yourself in case you’re injured, and you can help protect yourself with disability insurance.

Own-Occupation Disability Insurance

When shopping for disability insurance, it’s important to understand what to look for. In most cases, the best bet is own-occupation disability insurance. This type of disability insurance is defined as an insurance policy that covers those who have become disabled and are unable to perform the usual and customary duties of their own occupation. The claimant must be unable to perform the material and substantial duties related to their job. It’s contingent on the person being employed at the time in which the injury occurs or illness begins.

Own-occupation disability insurance is preferable to “any occupation” insurance because you are more likely to receive a benefit if you’re injured. Less expensive forms of disability insurance may require you to take any job that you are physically able to do, even if it pays much less than your former income. If you’re a nurse, you should strongly consider getting own disability insurance.

Look After Yourself and Your Family

You’ve worked hard and invested a great deal to get where you are. Protecting yourself with disability insurance can help you achieve the peace of mind that you need to focus on what’s important. Do your research and you’ll find the policy that’s best suited for you and your family.